Valutico for corporate users

See how Valutico helps Corporate Development, Investors Relations, and FP&A teams reduce reliance on external bankers, and assess their pipeline more rapidly, fairly, and accurately.

As the team responsible for inorganic growth, tasked with establishing strategic partnerships, and activities such as mergers and acquisitions (M&A), divestitures, and venture deals, Corporate Development (Corp Dev) is the valuation powerhouse of the corporate finance world.

Valutico empowers M&A teams and their colleagues in IR and Finance to achieve their growth goals with a suite of valuation tools for every need.

Data-first platform

Map the market to ground your strategy

Track the evolution of your publicly listed competitors valuations against their market cap and assess whether their stock is undervalued or overvalued against 15+ unique valuation methods, all grounded in up to date analysts consensus estimates.

Quickly assess every opportunity in your pipeline, private or public.

Create comprehensive models from even the most succinct CIMs and teasers as a way to provide early guidance to your stakeholders and to other parties. Search for peers that match your preferences (like industry, growth stage, revenue and other financial metrics) and relevant precedent transactions to zero in on the right valuation multiples before jumping into a full model.

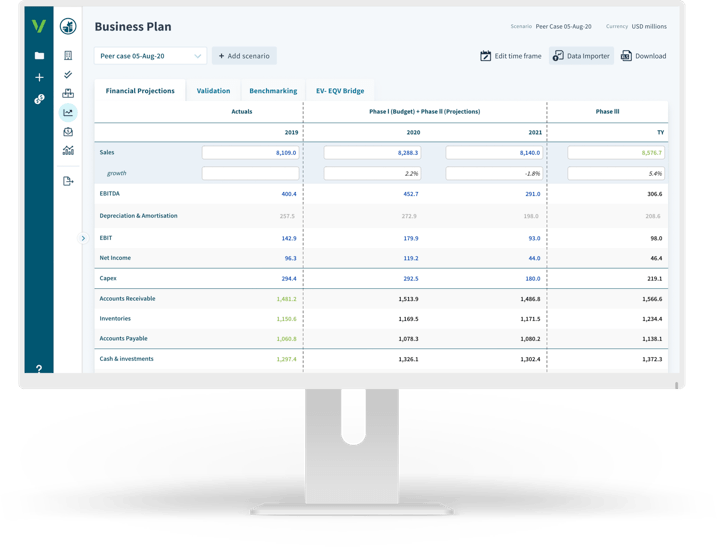

Analyze multiple integration scenarios

Iterate on your model in the Valutico platform, or input/output excel files to collaborate with external partners, and create unlimited scenarios to assess deal economics and business valuations from conservative or aggressive perspective. Build as many or as few scenarios as needed to meet your deal committee’s needs.

Tailor outputs and variables to your corporate standards

From customizing the design of the automatically-generated deliverables to match your colors and brand, to giving you full control over discounts and premiums so you can use your company’s hurdle rate in addition to a CAPM-based cost of capital calculation, Valutico adapts to your unique needs.

Find out why leading Corp Dev teams use Valutico

Exceptional Valuation Platform

Valutico is the world‘s leading provider of web-based company valuation tools.

Savings Delivered

Valutico users can analyze larger pipelines with the same resources. Industry data at your fingertips and reporting automation = 10x productivity

Transparent Calculations

Trust our model but own the data and audit any facet of the deliverables, choose your own cost of capital or use our model to create a deal specific WACC

Professional Grade

Your templates, your decisions, your reports. Valutico for corporate users follows your corporate brand and governance

Express ROI

Affordable valuation toolset and guaranteed rapid ROI. Valutico delivers immediate impact to your team’s budget

Whether your inorganic strategy is consolidation, expansion, or divestiture, Valutico supports your process with leading market data while saving you countless hours with automated reports and models.

Testimonials & Case Studies

Winning in client meetings with Valutico

“We prepare ourselves greatly before we engage with clients, and bring a lot of data to support our valuations. By bringing outside research to the table earlier than expected, we win more deals. Thanks to the variety of available peers and comparable transactions, from different countries, industries, and ranges of revenues, we can base our multiples on excellent, and defensible, market data.”